Latest Post Cyclemoneyco is redefining the way businesses manage their cash flow in today’s competitive market. Understanding and optimizing the cash cycle is vital for business success, and Cyclemoneyco provides innovative solutions that help companies improve efficiency and decision-making. With real-time data and advanced technology, it enables businesses to optimize their financial performance, enhance liquidity, and drive sustainable growth.

“Effective cash flow management is the backbone of a successful business, enabling growth, innovation, and financial stability.”

From offering mobile accessibility to simplifying cash cycle management, Cyclemoneyco gives businesses the tools to overcome challenges and unlock new opportunities. This approach has led to many success stories, with companies achieving remarkable improvements in their financial operations and overall performance. Through data analytics and an intuitive user interface, Cyclemoneyco is revolutionizing cash flow management, equipping businesses with the resources they need to thrive.

The Importance of Understanding the Cash Cycle

Understanding the cash cycle is crucial for managing working capital needs, improving liquidity, and enabling growth and innovation in businesses.

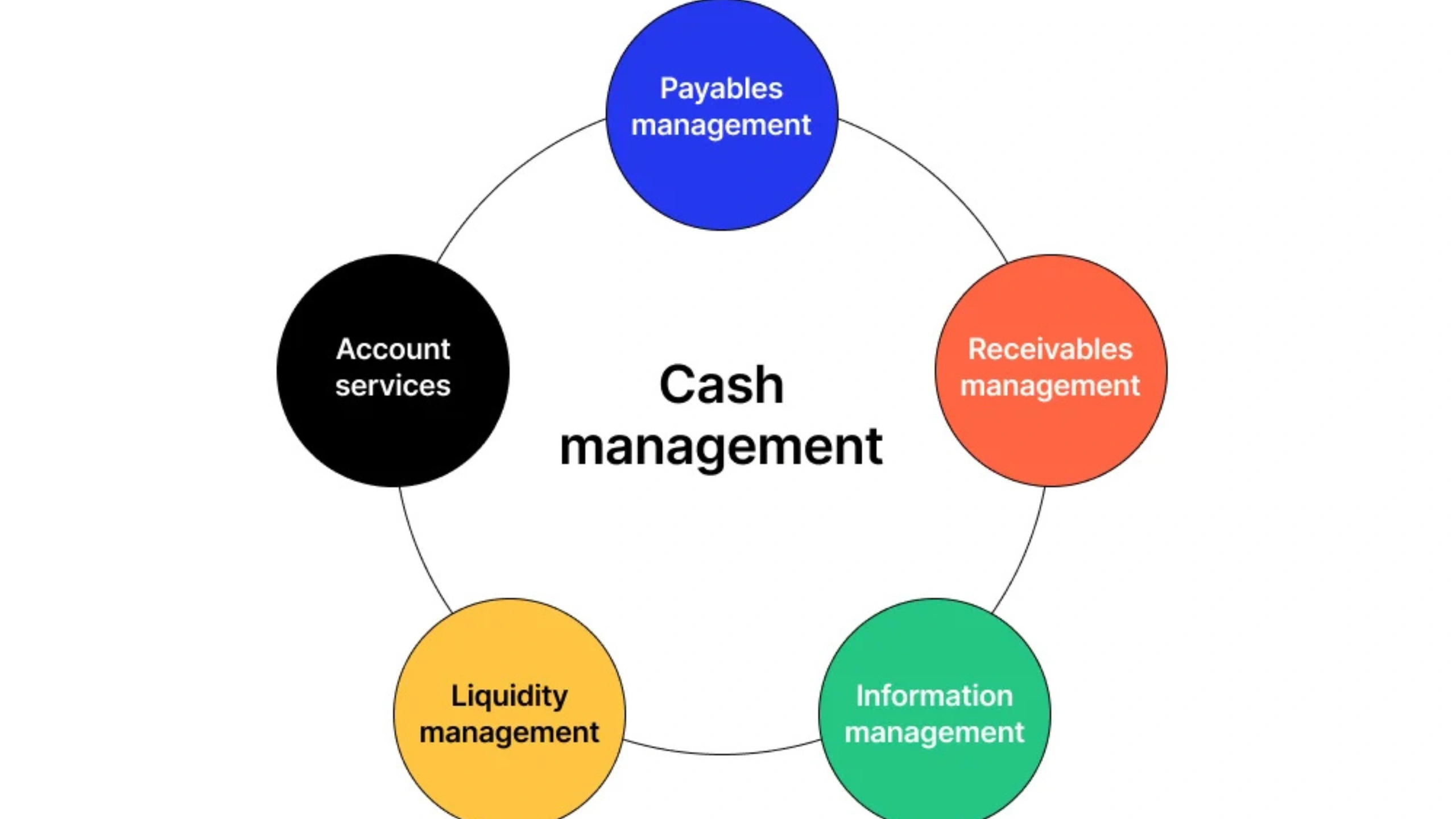

The cash cycle refers to the time it takes for a company to turn its investment in production into cash from sales. By understanding this process, businesses can better manage their working capital needs and ensure they have enough liquidity to cover day-to-day expenses. Efficient cash management allows a company to quickly recover its outlay and reinvest in new opportunities, helping foster growth, innovation, and financial freedom.

How Cyclemoneyco Revolutionizing Cash Flow Management?

Cyclemoneyco enhances cash flow management with cutting-edge technology and real-time data, helping businesses improve financial efficiency and decision-making.

Cyclemoneyco is changing the way businesses manage their cash flow by providing advanced tools that deliver real-time insights into their financial performance. These data analytics help identify inefficiencies, allowing companies to streamline operations and boost liquidity. With improved financial planning, businesses can drive growth and sustainability, gaining the autonomy to navigate challenges effectively. This approach not only supports better decision-making but also empowers organizations to achieve long-term financial health.

Features of Cyclemoneyco’s Digital Solutions

Cyclemoneyco offers mobile accessibility, an intuitive user interface, and a suite of features designed to streamline cash flow management and improve operational efficiency.

Cyclemoneyco’s digital solutions empower businesses to manage their finances seamlessly, providing real-time insights into cash cycles. The platform’s intuitive design ensures users can easily navigate, enhancing agility and reducing delays in operations. By offering enhanced accessibility, these solutions allow businesses to adapt quickly and optimize their financial performance in a dynamic market environment.

Businesses Achieving Success with Cyclemoneyco

Businesses using Cyclemoneyco’s digital solutions have seen remarkable improvements in cash flow management, driving growth and operational efficiency.

Organizations across various sectors have leveraged Cyclemoneyco to enhance their cash cycle optimization. For example, a retail company achieved a 30% increase in liquidity in just six months, while a manufacturing firm reduced receivables aging by 40%. These success stories demonstrate the platform’s ability to improve operations and help businesses navigate financial challenges. By streamlining liquidity and improving cash flow processes, Cyclemoneyco plays a vital role in supporting sustainable growth.

Conclusion

Latest Post Cyclemoneyco highlights how its innovative solutions significantly improve cash flow management, empowering businesses to optimize operations, enhance liquidity, and drive growth.

By adopting Cyclemoneyco’s cash cycle technologies and leveraging data analytics, businesses can streamline their financial processes, reduce inefficiencies, and make better decisions. With features like mobile accessibility, organizations can stay connected and adapt quickly to changing market conditions. These solutions pave the way for sustainable growth, increased profitability, and long-term success, making Cyclemoneyco a valuable tool for businesses looking to achieve financial stability and improved performance.